The credit rating of a corporation (tenant) is a summary opinion of the financial strength (or, default risk) of the corporation’s debt securities, most commonly, bond issues. Credit Ratings are issued by government-recognized rating agencies such as Standard & Poor’s, Moody’s, Fitch and A.M. Best. The ratings are typically denoted by letter designations such as A, B, C. These ratings can be upgraded or downgraded. To make life easier for investors, bonds are divided into two easy-to-understand groups: investment grade and non-investment grade.

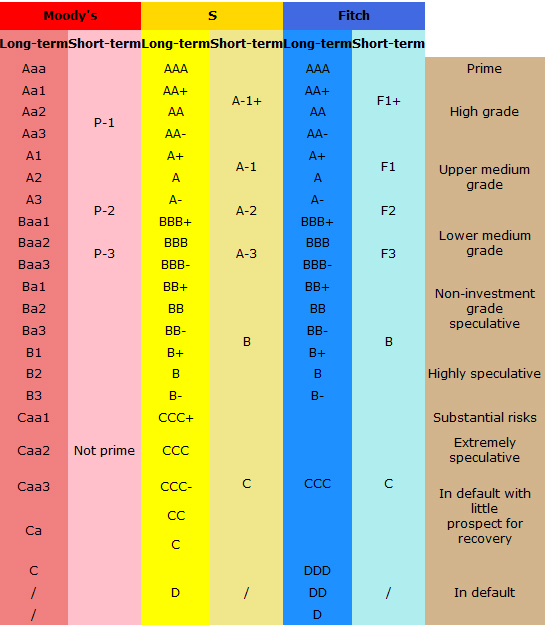

- (AAA = Prime);

- (AA, AA+, AA – = High Grade);

- (A, A+, A – = Upper medium grade);

- (BBB+, BBB, BBB – = Lower medium grade).

The higher the long-term rating of a corporation (tenant), the lower the risk associated with the investment and the lower the cap and the higher the price. For example, McDonalds, “Upper medium grade” sells at cap of ~ 5 and Blockbuster, “In default with little prospect for recovery” sold at cap of ~ 10.

- Standard & Poor’s (and Fitch’s) rating scale is as follows, from excellent to poor. (Anything lower than a BBB- rating is considered speculative or junk.) : AAA, AA+, AA, AA-, A+, A, A-, BBB+, BBB, BBB-, BB+, BB, BB-, B+, B, B-, CCC+, CCC, CCC-, CC, C, D.

- Moody’s rating system is similar in concept but the naming convention is a little different. It is as follows, from excellent to poor: Aaa, Aa1, Aa2, Aa3, A1, A2, A3, Baa1, Baa2, Baa3, Ba1, Ba2, Ba3, B1, B2, B3, Caa1, Caa2, Caa3, Ca, C.

- A.M. Best rates from excellent to poor in the following manner: A++, A+, A, A-, B++, B+, B, B-, C++, C+, C, C-, D, E, F, and S.

Investors should remember that without anything changing in the real world, a corporation’s rating can be changed because the rating agency has decided to change its approach or fundamental view of a sector As the property markets become more transparent and investors and issuers more critical, this credit ratings risk is diminishing.

The default probabilities below are a forecast measure of the likelihood of a tenant’s inability to make scheduled repayments on their long-term debt five years into the future. Should the borrower be unable to pay i.e. default, lenders can attempt to obtain repayment. Generally speaking, the higher the probability of default, the higher the interest rate a lender charges the borrower (as compensation for bearing higher default risk.

| Rating | Probability of Default % |

|---|---|

| AAA | 00.52% |

| AA | 01.31% |

| A | 02.32% |

| BBB | 06.64% |

| BB | 19.52% |

| B | 35.76% |

| CCC | 54.38% |

Companies with a rating of BBB- and higher (S&P scale) are considered “investment grade”. The higher the rating of a company, the lower the risk associated with the investment and the lower the cap and the higher the price. For example, McDonalds, “Upper medium grade” sells at cap of ~ 5 and Blockbuster, “In default with little prospect for recovery” sells at cap of ~ 10.